As an growing variety of Canadian employers make use of overseas employees, and the Authorities of Canada is taking an more and more strict strategy in implementing the foundations regulating the employment of overseas employees, the problem of how firms can shield themselves once they purchase firms that make use of overseas employees is changing into more and more vital.

As effectively, as defined intimately on the Immigration, Refugees and Citizenship Canada (“IRCC”) web site, company restructurings, mergers and acquisitions might themselves set off work permit-related points for employer compliance.

It’s accordingly vital for all firms which are contemplating merging with or buying one other firm to contemplate whether or not (a) the transaction will outcome within the want for brand spanking new work permits for current workers and (b) whether or not the corporate that might be using these overseas employees will change into responsible for any non-compliance of the earlier entity.

Understanding the “Successor in Curiosity” Idea

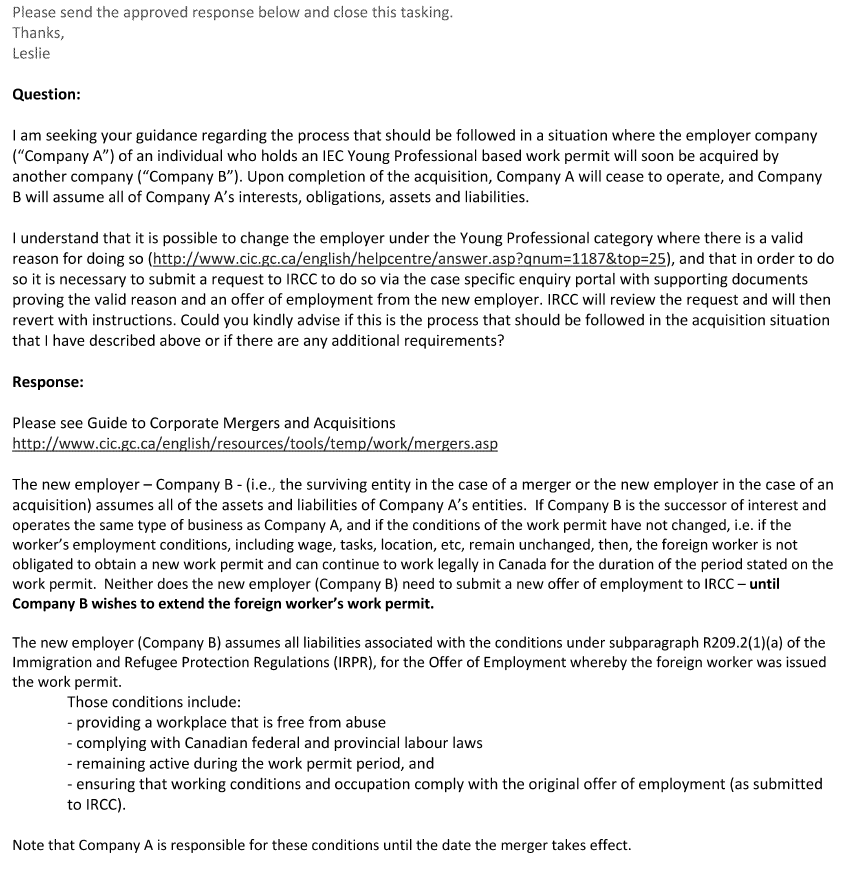

Whereas the IRCC web site is evident that employers change into answerable for compliance submit restructuring, merger or acquisition, the problem of whether or not the brand new employers change into responsible for earlier non-compliance is extra nuanced, and depends upon whether or not the brand new employer has change into the “successor in curiosity” for the portion of the group the place the non permanent overseas employees have been employed.

A “successor in curiosity” happens the place the brand new firm or the purchaser considerably assumes the pursuits and obligations, belongings and liabilities of the unique proprietor and proceed to function the identical varieties of enterprise as the unique proprietor. There isn’t a fastened definition of what “considerably assumes” entails, however firms ought to take into account whether or not the brand new entity submit restructuring, merger or acquisition has assumed the present belongings, long run investments, property, human sources, patents, accounts payable, present liabilities, long-term liabilities, and continued employment of workers.

If the take-over group is a successor in curiosity in that it has considerably assumed the pursuits, obligations, belongings and liabilities of the unique group (wholly or partially) and continues to function the identical kind of enterprise as the unique group, the take-over group stays the “employer” for the aim of the present work allow as effectively.

Are New Work Permits Wanted?

The place the brand new group is a successor in curiosity, a change in possession construction is not going to require a brand new LMIA or supply of employment. If it’s not, then a brand new LMIA or supply of employment and new work permits are required, and the workers ought to stop working for the take-over group till new work permits have been obtained.

The place there’s a company restructuring, merger or acquisition, the holder of a Labour Market Impression Evaluation (an “LMIA”) ought to contact the Division of Employment and Social Growth Canada to tell them of the change. Whether or not a brand new LMIA might be required will rely upon a wide range of elements, together with whether or not the company restructuring, merger or acquisition impacts the prevailing wage, job description and job duties of a overseas employee.

The identical is true for IRCC’s Worldwide Mobility Program (the “IMP”). The employers of Intra-Firm Transferees, for instance, might want to decide whether or not a qualifying relationship continues to exist following a restructuring, merger or acquisition. As effectively, after the restructuring, merger or acquisition the brand new employer must fastidiously overview the phrases and circumstances on every overseas employee’s work allow to find out whether or not there are any limitations on modifications to job title, location, wages and duties. If there are, then new work permits could also be crucial, relying on the work allow program that the overseas employee is employed underneath.

Legal responsibility

Typically, the place the brand new entity shouldn’t be a successor in curiosity, then they assume the accountability of complying with the Non permanent Overseas Employee Program or the IMP on a going-forward foundation, however don’t assume the liabilities of the earlier employer with respect to overseas employee compliance. The place the brand new employer is a successor in curiosity, then they do assume these liabilities.

Steps Corporations Ought to Take

There are a number of steps that firms can take to attenuate threat when buying or merging with an organization that employs overseas employee.

First, as soon as the restructuring, merger or acquisition is completed, then the brand new firm might wish to notify IRCC. For instance, if a corporation modifications its title or deal with, and there are not any different modifications to the construction of the corporate or to its Canada Income Company enterprise quantity, then the group ought to contact IRCC to replace their employer compliance portal info. The place there’s a change in CRA quantity, the employer ought to ask IRCC to hyperlink the brand new CRA quantity to their employer portal account. Requesting such modifications don’t delay the issuance of latest work permits.

Second, previous to finishing the acquisition or merger, the group ought to audit the opposite entity’s compliance with the employment of overseas nationals. This contains acquiring a listing of all overseas employees that the corporate has employed inside the previous six years (as that is the interval that the federal government assesses), scrutinize whether or not the earlier firm complied with the legal guidelines regulating overseas employees after which decide what steps are wanted going ahead.

Third, the buying entity might wish to include of their buying settlement wording that indemnifies them of any non-compliance by the earlier overseas employee. For instance, now we have acted for purchasers the place they efficiently negotiated indemnifications in opposition to the results of any authorities inspections or audits of the brand new employer relating to the earlier entity’s non-compliance, and likewise to cowl the authorized charges and prices of any voluntary disclosures to ESDC or IRCC needed to be made following the invention by the brand new employer of non-compliance by the earlier employer.

Lastly, the place non-compliance is found, the purchaser ought to take detailed data, and take into account making a voluntary disclosure to the Authorities of Canada. This might enormously cut back the results of non-compliance.

Conclusion

The implications of not complying with Canada’s legal guidelines and laws relating to the employment of overseas nationals might be extreme, and embody fines and prohibitions on hiring overseas employees. Relying on the circumstances, current work permits could also be revoked. The purchaser of a enterprise may discover themselves financially devastated if, for instance, the Authorities of Canada have been to seek out them non-compliant. For instance, a person who purchases a restaurant the place the entire cooks are overseas employees may discover themselves swiftly out of enterprise if the earlier employer’s non-compliance implies that the brand new employer is each fined and prohibited from using overseas employees. As such, it is crucial that they take steps to guard themselves.